Costs and Reduction of Costs in Arbitration Article

With advancements in technology, it has become extremely difficult to profit from pricing errors in the market. Many traders have computerized trading systems set to monitor fluctuations in similar financial instruments. Any inefficient pricing setups are usually acted upon quickly, and the opportunity is eliminated, often in a matter of seconds. In Gammon Engineers v. NHAI, the Supreme Court acknowledged the rights of the parties to agree to a fee structure which would also be binding upon the tribunal that consents to decide upon the dispute. Much recently, the issue of unreasonably high costs of arbitrations came up for consideration again before the Supreme Court in the proceedings presently underway in the case of Oil and Natural Gas Corporation Ltd. v. AFCONS Gunasuna JV.

The depth of services and the unique global perspective we bring to the table is what differentiates us. Especially in the area of high-volume consumer finance, collection and disbursements in insurance, housing finance, business process management and looking beyond work flow. In business intelligence, analysis and reporting – we work not only in silos but bring it together and deliver a basket of solutions that is appealing to our customers. The outsourced market is a very crowded one therefore the only reason that customers work with us is because we help them bridge the gap and bring value proposition to the table. The depth and longevity of these elements can also be assessed from the fact that a bulk of our revenues come from clients who have been with us for 12 months and more. The Second Wave of Outsourcing saw a continuation of the cost arbitrage logic, with BPO and IT getting combined in an integrated offering to customers.

Arbitrage is the simultaneous purchase and sale of an asset in different markets to exploit tiny differences in their prices. Kimchi premium is the gap in cryptocurrency prices, notably bitcoin, in South Korean exchanges compared to foreign exchanges. Arbitrage is the simultaneous purchase and sale of the same asset in different markets in order to profit from a difference in its price.

It enables us to provide the right solutions for the customer. The latest step in this journey has been the creation of a dedicated Investment Banking solutions centre in Hyderabad – The Capital, the first of its kind in the world. If a bank is to ‘change while it runs’, it needs a solution provider who understands banking so well that it can protect the existing business of the customer even while adding to it and enhancing it. The level of domain knowledge, specifically banking knowledge that the solutions provider must bring to the table is several notches higher than in conventional outsourcing.

Once again, this refers to a cost like an abeyance fee or hearing room rental fee. Of course, the terms of a contract or agreement might dictate the division of costs. Plus, there are costs that parties must each pay on their own. This can refer to the costs parties spend when preparing to present their cases. Every party must pay certain legal costs, as they would in any US court.

Assumptions in the Arbitrage Pricing Theory

Pete Rathburn is a copy editor and fact-checker with expertise in economics and personal finance and over twenty years of experience in the classroom. The offers that appear in this table are from partnerships from which Investopedia receives compensation. Investopedia does not include all offers available in the marketplace.

It is best to choose a risk assessment model depending on the risks one chooses to involve with an asset. Similarly, the traders purchase an asset at a lower price from one stock exchange. Then they sell the same asset at a higher price in another stock exchange. Again, all this is done in real-time to benefit from the price difference.

A two minus part tariff comma the place goods promote for a different comma higher price in different countries. arbitrage, where customers pay one value to buy as much of a good as they need at a second value. For instance, a dealer may buy a inventory on a foreign exchange the place the price has not but adjusted for the constantly fluctuating change price. The price of the inventory on the international change is therefore undervalued in comparison with the value on the local change and the dealer could make a revenue from this distinction. These factors provide risk premiums for investors to consider because the factors carry systematic risk that cannot be eliminated by diversifying.

Arbitration in Switzerland

DerivativesDerivatives in finance are financial instruments that derive their value from the value of the underlying asset. The underlying asset can be bonds, cost arbitrage stocks, currency, commodities, etc. The four types of derivatives are – Option contracts, Future derivatives contracts, Swaps, Forward derivative contracts.

- Being an eternal optimist, I strongly believe that this is the right time for Indian IT companies to pass on the right message and offer the right proposition to US corporations.

- But first of all, the stock price will go up, not because of what Infosys is doing, because what the world is doing in terms of printing the money is very essential.

- This was a designed strategy and our value proposition has always been that cost arbitrage is a good byproduct of how we operate but it is not the only reason to work with us.

- Every party must pay certain legal costs, as they would in any US court.

- Party fees make up an average of 83% of the total arbitration costs whilst procedural fees remain much lower in comparison.

It exploits short-lived variations in the price of identical or similar financial instruments in different markets or in different forms. An arbitrage trading program is a computer program that seeks to profit from financial market arbitrage opportunities. However, on the other end, the dilemma for the PSUs of entering into arbitration agreements with big private entities persists. Private entities with deep pockets may not hesitate to engage in high-cost arbitrations, especially with many other variables such as market sentiments in consideration.

Sebi asks MFs to collect shares worth four times the investment as collateral. There are many different arbitrage strategies that exist, some involving complex interrelationships between different assets or securities. Investopedia requires writers to use primary sources to support their work.

Commercial Litigation Mediators

In cases of ad-hoc arbitration arbitrators are free to charge as per their will, however, they usually stick to the competitive market rates which in order to stay in business. Therefore, the rats of fees are usually close to the figures mentioned in the Fourth Schedule and Rules of various Arbitration Institutes. The losing party often pays the cost of legal expenses incurred by the winning party. Arbitrators and the Arbitration Agreements are mostly guided by the will of the parties, therefore, they can lay whatever guidelines they agree to be followed in the proceedings. However, the proceedings at all times must follow the principles of natural justice and equity.

Warren Buffett at 6 years old saw that he could profit from arbitrage. He would purchase a 6-pack of Coca-Cola for 25¢ and sell each bottle for 5¢ in his neighborhood, profiting 5¢ per pack. Young Warren Buffett saw that he could profit from the difference in the price of a six-pack versus what people were willing to pay for a single bottle. Accuracy –Since the APT is based on multiple factors, it is typically considered a more accurate model.

An arbitrator is a neutral individual that will decide your case, sort of like a courtroom judge. Instead, he or she gets paid by the disputing parties in an arbitration case. The rate depends on how much work the arbitrator must put in on the case. Each arbitrator gets paid based on an exact rate for compensation. The rate can vary based on the unique arbitration rules and terms of the case. Sometimes an arbitrator sets up a fee or rate schedule with the disputing parties.

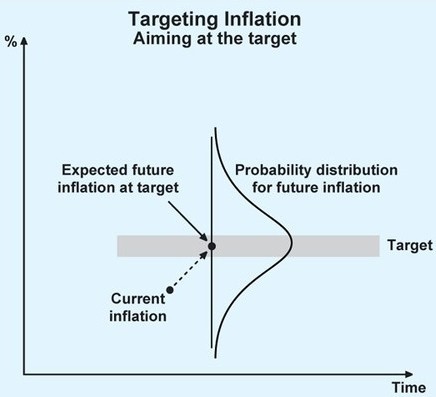

The APT suggests that the returns on assets follow a linear pattern. An investor can leverage deviations in returns from the linear pattern using the arbitrage strategy. Arbitrage is the practice of the simultaneous purchase and sale of an asset on different exchanges, taking advantage of slight pricing discrepancies to lock in a risk-free profit for the trade. Compared to the CAPM, the arbitrage pricing model takes into account multiple factors of risk.

It was a way to expand the market, in some sense, horizontally, by offering services related to IT, rather than IT alone. It is a very bright spot in the services that Infosys is providing. It is going to be a revenue driver and also would be an anchor for all Indian IT services moving forward. But first of all, the stock price will go up, not because of what Infosys is doing, because what the world is doing in terms of printing the money is very essential.

Arbitrage Explained

But the actual price is $210, and therefore, the stock would be considered overvalued. According to the APT theory, it should correct itself, presenting an arbitrage opportunity. It is done to benefit from market discrepancies; thus, it indirectly improves the markets by highlighting loopholes. But the regulators have often narrowed the scope of arbitrage. Bettors can still gain from retail, securities, dividends, and futures.

Learn to figure out when should you prefer arbitration over courts while advising your clients or negotiating for agreements. Apart from being the founder of this blog, I am a lawyer and an entrepreneur. I hope you enjoy learning about the law and understanding how it can be used in the real world both as a weapon and a shield. All the appeals should be filed in the High Court of the jurisdiction of the disputes. In the case of Executive Engineer, Road Development Division No.III, Panvel & Anr.

Identify stocks that will see a boom because of virus: Nassim Nicholas Taleb

External legal costs are followed by expert costs, with a percentage of 10%. In order to comment on the possible ways to reduce costs in arbitration, understanding the repartition of costs and fees is important. Some interesting numbers from the Survey shed light on the understanding of repartition of costs.

Some judgments suggest that the model fee under the Fourth Schedule is a suggestive and derogable provision of law. Any co-operation in facilitating the proceedings as to time and cost. It is also interesting to note that claimants spend 12% more than respondents in arbitration proceedings8. For example, the costs of arbitrating disputes between US$10 and 100 million were reported to vary between an average of US$280,345 on and hourly basis and a lower average of US$161,800 for an ad valorem basis. Shrinking IT budgets in the US, and not Barack Obama’s anti-outsourcing rhetoric, will hurt the Indian software industry, which has to move away from showcasing benefits out of hourly billing models, says the CEO of iGate.